|

LVrealestateHELP.com

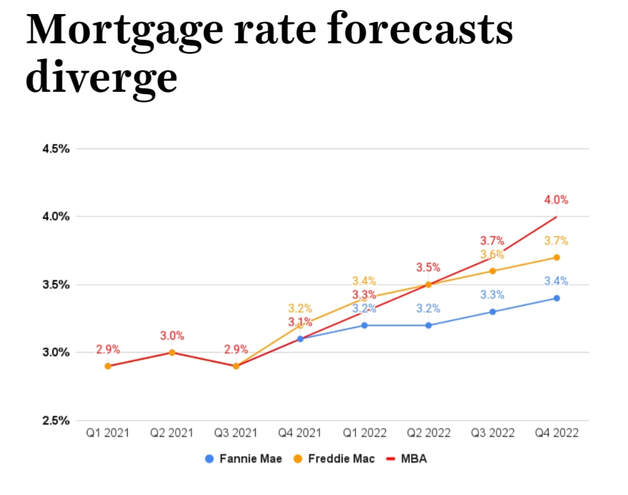

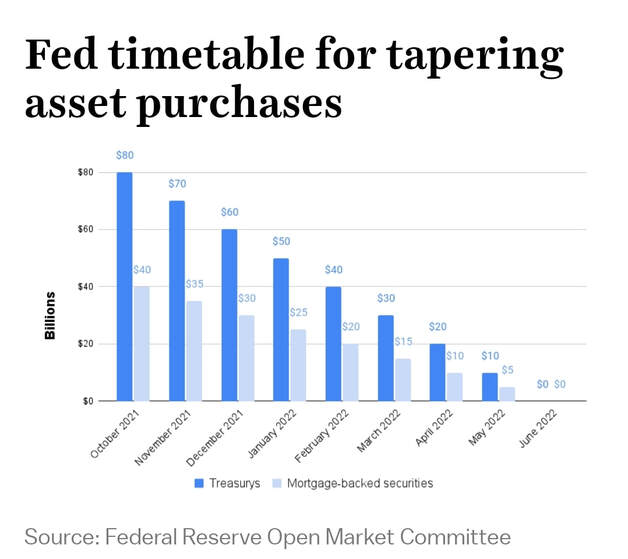

Mortgage rates are rising due to a few factors. One of them is an effect of the inflation we have been experiencing. Another is due to the Fed tapering off the amount of Mortgage Backed Secuirities it purchases on the secondary market. Back in 2020 when the pandemic first begun the Fed drastically increased the amount of MBS it purchases in order to increase liquidity for lenders so they have more cash on hand to originate new loans. While the changes in rates are not huge, the higher the rates go the more "affordability" will come into play. With home values at all time highs and some buyers already getting priced out of the market, rising rates will only compound that problem by lowering buyers buying power. If buyer's are on the fence about buying now or next year, my advice is to lock in a rate now before rates and prices continue to increase.

This chart shows the Feds plan and forecast of continuing to taper off the amount of Mortgage Backed Secuirities it is purchasing in the secondary market. This adjustment will directly impact the amount of fund that lenders have to lend, thus lowering the supply side of available funds accessible to originate new loans. As we all know basic supply and demand will tell us that with less supply of money to lend will cause the price to obtain that money to increase. The tapering off shoud be completed and phased out by June 2022 per the chart above.

Best Regards, NV Broker/Salesman at The Adams Team at Rothwell Gornt Companies MA & RI Real Estate Broker at Sankey Real Estate Las Vegas Real Estate Help © 2017 LVrealestateHELP.com All Rights Reserved.

|

Blog Author:

|